Edward O Thorp And Associates

- Edward O Thorp And Associates Cambridge

- Edward O Thorp And Associates Llc

- Edward O. Thorp And Associates

Mathematical Finance A Public Index for Listed Options Can Joe Granville Time the Market? Common Stock Volatilities in Option Formulas Concave Utilities are Distinguished by their Optimal Strategies Extensions of the Black Scholes Option Model Medium Term Simulations of the Full Kelly and Fractional Kelly Investment Strategies The Cost of Liquidity Services in Listed Options:.

- Updated world stock indexes. Get an overview of major world indexes, current values and stock market data.

- The latest tweets from @EdwardOThorp.

| Born | August 14, 1932 (age 88) Chicago, Illinois |

|---|---|

| Citizenship | American |

| Alma mater | UCLA |

| Known for | blackjack system; wearable computers; stock market investment |

| Scientific career | |

| Fields | Probability theory, Linear operators |

| Institutions | UC Irvine, New Mexico State University |

| Influences | Claude Shannon |

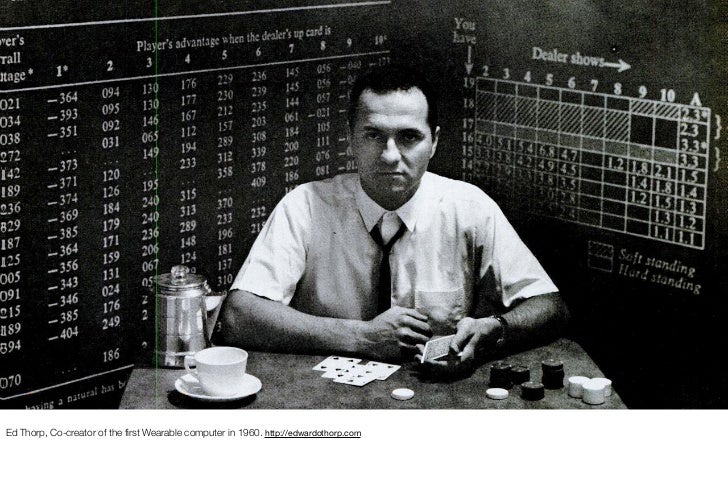

Edward Oakley Thorp (born 14 August 1932) is an American mathematics professor, author, hedge fund manager, and blackjack player. He is best known as the author of Beat the Dealer (1962). This was the first book to prove that the house advantage in blackjack could be overcome by card counting.[1] As part of this work he collaborated with Claude Shannon in creating the first wearable computer in 1961.[2][3]

Thorp also developed and applied effective hedge fund techniques in the financial markets. He was a pioneer in modern applications of probability theory, including the harnessing of very small correlations for reliable financial gain.

Thorp received his Ph.D. in mathematics from the University of California, Los Angeles in 1958, and worked at M.I.T. from 1959 to 1961. He was a professor of mathematics from 1961–1965 at New Mexico State University, and then joined the University of California, Irvine where he was a professor of mathematics from 1965 to 1977 and a professor of mathematics and finance from 1977 to 1982.

Stock market[change change source]

Since the late 1960s, Thorp has used his knowledge of probability and statistics in the stock market by discovering and exploiting a number of pricing in the securities markets. Thorp is currently the President of Edward O. Thorp & Associates, based in Newport Beach, CA. In May 1998, Thorp reported that his personal investments yielded an annualized 20 percent rate of return averaged over 28.5 years.[4]

Books[change change source]

- Thorp, Edward O. (1966). Beat the Dealer: A Winning Strategy for the Game of Twenty One. Vintage. ISBN0-394-70310-3.

- Edward O. Thorp 1967. Beat the market: a scientific stock market system, 1967, ISBN978-0-394-42439-2 (online versionArchived 2009-10-07 at the Wayback Machine)

- Thorp, Edward O. (1977). Elementary Probability. Krieger Publishing Company.

- Thorp, Edward (1984). The Mathematics of Gambling. Lyle Stuart. ISBN978-0-89746-019-4.

Edward O Thorp And Associates Cambridge

References[change change source]

Edward O Thorp And Associates Llc

- ↑Griffin, Peter A. (1999). The Theory of Blackjack: The Compleat Card Counter's Guide to the Casino Game of 21. Anthony Curtis. ISBN978-0-929712-13-0.

- ↑Edward O. Thorp. 'The invention of the first wearable computer'(PDF). Edward O. Thorp & Associates. Archived from the original(PDF) on 28 May 2008. Retrieved 26 April 2010.

- ↑Mann, Steve 2012. Wearable computing. In: Soegaard et al (eds) Encyclopedia of human-computer interaction. Aarhus, Denmark: The Interaction-Design.org Foundation.

- ↑'Thorp's market activities'. Webhome.idirect.com. Retrieved 2010-04-26.