Kelly Criterion

Bettors should always look for a mathematical edge rather than rely on their impulses. Learning how to use the Kelly Criterion, for example, is a great way for bettors to determine how much they should stake. Read on to find out.

Prior to placing a bet bettors should consider six important questions: who, what, when, where, why and how? But for this article, it is the how, as in how much to bet, we are interested in.

- The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event.

- The Kelly Criterion was first introduced by J.L. Kelly who was a researcher for Bell Labs in 1956. The idea behind the theorem is to maximize wealth as the number of observations (or bets) goes to infinity. Though originally created for financial portfolios, it has been borrowed by the sports betting community for bet size management.

The Kelly Criterion is a popular staking method which suggests that your stake should be proportional to the perceived edge. Kelly Criterion Staking Method Explained What is the Kelly Criterion formula? The basic Kelly Criterion formula is: (bp-q)/b B = the Decimal odds -1 P = the probability of success Q = the probability of failure.

Kelly Criterion Forex

Popular staking method which suggests that stake should be proportional to the perceived edge.

Consider placing a bet on the English Premier League. We can adapt these questions accordingly:

- Who to bet on? Manchester United

- What to bet on? Top 4 finish

- When to bet on? Now

- Where to bet on? Pinnacle tend to offer the best odds

- Why to bet on? They seem to be under-priced

- How much? How much to bet on this outcome?

Most articles focus on the first five questions, typically using mathematical or statistical justifications on answering ‘why’ - such as the article on how to use Monte Carlo methods.

In making financial decisions, the key issue is not only finding the adequate financial products to invest in but also deciding how to subdivide one’s portfolio. Similarly, an important question for a bettor, is how much to wager?

Many papers recommend using the Kelly Criterion or a derivative of it - such as my 2013 paper appearing in the The Journal of Gambling Business and Economics. In essence, the Kelly Criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds grow exponentially.

B = the Decimal odds -1

P = the probability of success

Q = the probability of failure (i.e. 1-p)

Using a coin as an example of Kelly Criterion staking

For example, consider you are betting on a coin to land on heads at 2.00. However, the coin is biased and has a 52% chance of ending up on heads.

In this case:

P= 0.52

Q = 1-0.52 = 0.48

B = 2-1 = 1.

This works out at: (0.52x1 – 0.48) / 1 = 0.04

Therefore the Kelly Criterion would recommend you bet 4%. A positive percentage implies an edge in favour of your bankroll, so your funds grow exponentially. You can also test the criterion for different values in this online sheet by using the code below.

Ultimately the Kelly Criterion offers a distinct advantage over other staking methods such as Fibonacci and Arbitrage methods as there is a lower risk. However, it does require precise calculation of the likelihood of an event outcome, and discipline of this method will not provide explosive growth of your bankroll.

Keep up-to-date with more top-notch betting articles by following us on Twitter @PinnacleSports.

Kelly Criterion Formula

Introduction

J.L.Kelly, in his seminal paper A New Interpretation of Information Rate (Bell System Technical Journal, 35, 917-926 see below) asked the interesting question: how much of my bankroll should I stake on a bet if the odds are in my favor? This is the same question that a business owner, investor, or speculator has to ask themself: what proportion of my capital should I stake on a risky venture?

Kelly did not, of course, use those precise words — the paper being written in terms of an imaginary scenario involving bookies, noisy telephone lines, and wiretaps so that it could be published by the prestigious Bell System Technical journal.

Assuming that your criterion is the same as Kelly's criterion — maximizing the long term growth rate of your fortune — the answer Kelly gives is to stake the fraction of your gambling or investment bankroll which exactly equals your advantage. The form below allows you to determine what that amount is.

Disclaimer

- The Kelly Strategy Bet Calculator is intended for interest only.

- We don't recommend that you gamble.

- We don't recommend that you place any bets based upon the results displayed here.

- We don't guarantee the results.

- Use entirely at your own risk.

Kelly Strategy Bet Calculator

Results

- The odds are in your favor, but read the following carefully:

- According to the Kelly criterion your optimal bet is about 5.71% of your capital, or $57.00.

- On 40.0% of similar occasions, you would expect to gain $99.75 in addition to your stake of $57.00 being returned.

- But on those occasions when you lose, you will lose your stake of $57.00.

- Your fortune will grow, on average, by about 0.28% on each bet.

- Bets have been rounded down to the nearest multiple of $1.00.

- If you do not bet exactly $57.00, you should bet less than $57.00.

- The outcome of this bet is assumed to have no relationship to any other bet you make.

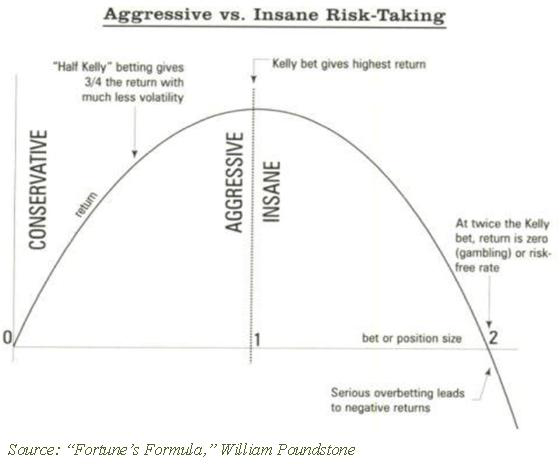

- The Kelly criterion is maximally aggressive — it seeks to increase capital at the maximum rate possible. Professional gamblers typically take a less aggressive approach, and generally will not bet more than about 2.5% of their bankroll on any wager. In this case that would be $25.00.

- A common strategy (see discussion below) is to wager half the Kelly amount, which in this case would be $28.00.

- If your estimated probability of 40.0% is too high, you will bet too much and lose over time. Make sure you are using a conservative (low) estimate.

- Please read the disclaimer below.

More Information

The BJ Math site used to contain a great collection of papers on Kelly betting, including the original Kelly Bell Technical System Journal paper. Unfortunately it is now defunct, and only contains adverts for an online casino. However, you can find much of the content through the Wayback Machine archive. The Internet Archive also contains a copy of Kelly's original paper which appeared as A New Interpretation of Information Rate, Bell System Technical Journal, Vol. 35, pp917-926, July 1956. (If this link breaks — as it has done several time since this page was written — try searching for the article title).

We based the above calculations on the description given in the book Taking Chances: Winning With Probability by John Haigh, which is an excellent introduction to the mathematics of probability. (Note that there is a misprint in the formula for approximating average growth rate on p359 (2nd edition) and the approximation also assumes that your advantage is small. There is a short list of corrections which can be found through John Haigh's web page).

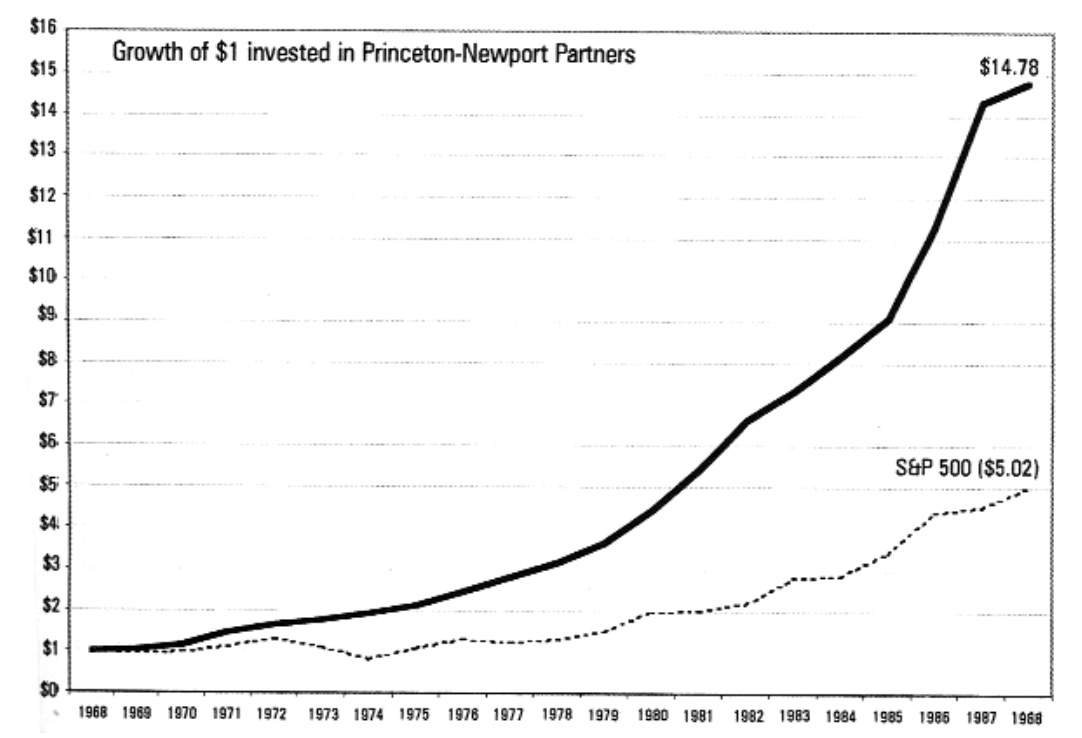

Note that although the Kelly Criterion provides an upper bound on the amount that should be risked, there are sound arguments for risking less. In particular, the Kelly fraction assumes an infinitely long sequence of wagers — but in the long run we are all dead. It can be shown that a Kelly bettor has a 1/3 chance of halving a bankroll before doubling it, and that you have a 1/n chance or reducing your bankroll to 1/n at some point in the future. For comparison, a “half kelly” bettor only has a 1/9 chance of halving their bankroll before doubling it. There's an interesting discussion of this (not aimed at a mathematical reader) in Part 4 of the book Fortune's Forumla which gives some of the history of the Kelly criterion, along with some of its notable successes and failures.

Jeffrey Ma was one of the members of the MIT Blackjack Team, a team which developed a system based on the Kelly criterion, card counting, and team play to beat casinos at Blackjack. He has written an interesting book The House Advantage, which examines what he learned about managing risk from playing blackjack. (He also covers some of the measures put in place by casinos to prevent the team winning!)

- Blackjack: Play Like The Pros: A Complete Guide to BLACKJACK, Including Card Counting, , Lyle Stuart, 2006.

- The Game Plan: How Casual Players Become Threats in No Limit Hold ’Em Tournaments, , Independently published, 2019.

- Blackbelt in Blackjack : Playing 21 as a Martial Art, , Cardoza, 2005.

- Beat the Dealer: A Winning Strategy for the Game of Twenty-One, , Vintage, 1966.

- High-Leverage Casino Gambling Systems: How to play like a minnow and score like a whale on your next casino visit, , CreateSpace Independent Publishing Platform, 2012.

- Gambling and War: Risk, Reward, and Chance in International Conflict, , Naval Institute Press, 2017.

- The World's Greatest Blackjack Book, , Crown, 1987.

- Math of Poker Basic: Pile Up Money and Professional Player: Essential Poker Math, , Independently published, 2020.